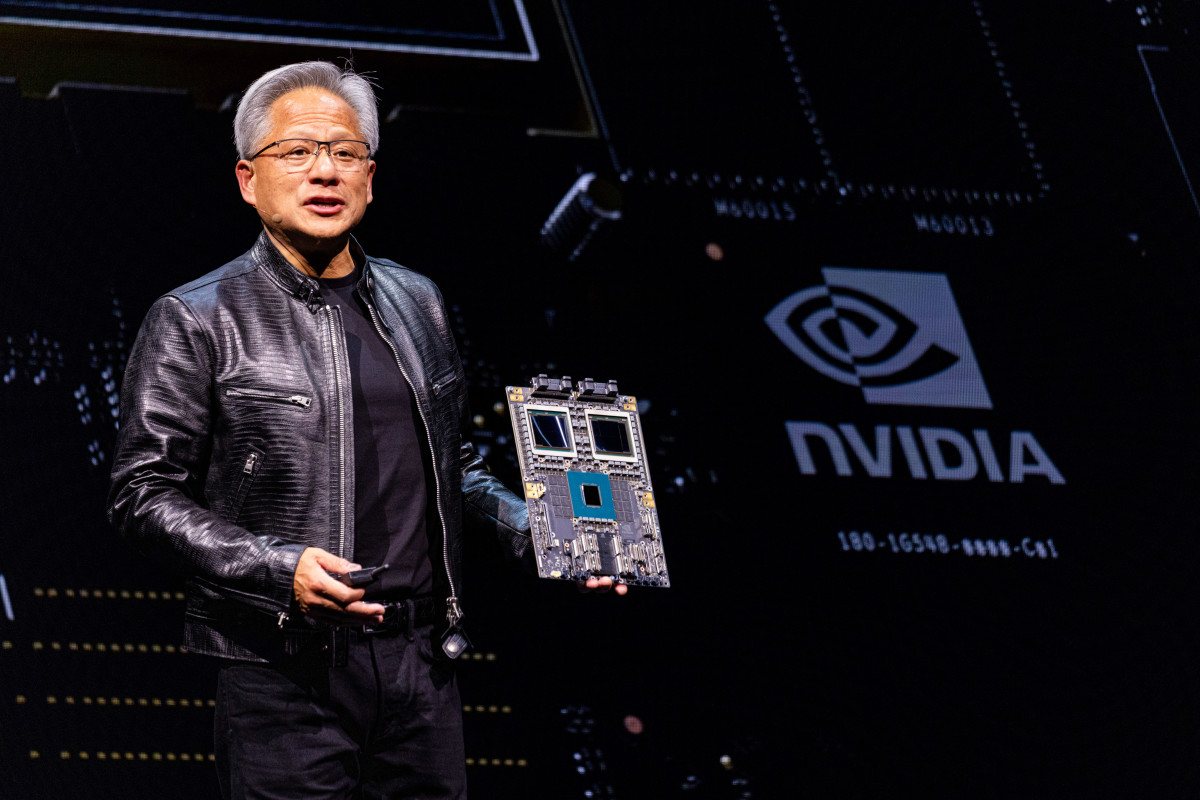

Nvidia’s Earnings Spark Market Moves as Analysts Recommend Buying the Dip

In the latest market news, Nvidia's recent earnings report has stirred up quite a reaction, with futures edging higher in premarket trading. This comes as investors digest Nvidia's results and anticipate upcoming economic data that could influence market trends.

On Thursday morning, Nasdaq and S&P 500 futures showed a slight increase after Nvidia, a key player in the AI chip sector, released its quarterly earnings. Despite the positive overall results, Nvidia's shares experienced a 2% dip in premarket trading. This decline was fueled by forecasts that fell in line with expectations, leading some to believe that the company's growth momentum might be losing steam. Ryan Detrick, chief market strategist at Carson Group, noted that while Nvidia is still experiencing impressive revenue growth of 122%, the company’s recent earnings beat was smaller than previous quarters, and guidance wasn’t as robust as anticipated.

Also Read:- AFL Awards 2024: Max Gawn Makes History as All-Australian Team is Announced

- North Queensland Cowboys Triumph Over Storm in Thrilling NRL Clash

In addition to Nvidia's performance, the broader semiconductor sector felt the impact. Shares of major peers like Broadcom and Advanced Micro Devices fell by 0.3% each. However, gains in Nvidia's high-profile customers helped cushion the blow. Companies like Microsoft, Meta, Alphabet, and Amazon all saw slight increases, bolstered by market enthusiasm over the potential for AI to drive corporate profitability. Apple also saw a notable gain of 1.2%.

The market is currently in a phase of cautious optimism, with key indices like the S&P 500 and Dow hovering near record highs. Investors are eagerly awaiting upcoming economic reports, including the second estimate of U.S. GDP for the second quarter and weekly jobless claims data. These reports, along with Friday's Personal Consumption Expenditure data, could provide further clues about the Federal Reserve’s future monetary policy. Analysts are speculating that there’s a strong chance of a 25 basis points rate cut in the Fed's September meeting, with odds at 63.5%.

Amidst these developments, Wall Street analysts are suggesting that the recent dip in Nvidia’s stock could present a buying opportunity. Piper Sandler’s Harsh Kumar and UBS analyst Timothy Arcuri both recommend buying the stock despite the short-term pullback. Kumar highlighted that Nvidia’s fundamentals remain strong, even if gross margins have seen some compression. Arcuri pointed to bullish key indicators and ongoing strong demand for AI technologies.

Furthermore, Bernstein’s Stacy Rasgon and Morgan Stanley’s Joseph Moore have both raised their price targets for Nvidia, reflecting continued confidence in the company's growth potential. Rasgon has set a new target of $155, while Moore has increased his to $150. Both analysts emphasize Nvidia’s position as a leader in AI and its anticipated growth from new product lines.

Overall, while Nvidia’s short-term results may have caused some turbulence, analysts remain optimistic about the company's long-term prospects, driven by its strong foothold in AI technology and upcoming innovations. For investors, this might be a moment to consider the stock as part of a broader investment strategy, particularly if the dips align with long-term growth opportunities.

Read More:

0 Comments