MicroStrategy's Bold Move Could Transform Bitcoin's Market Dynamics

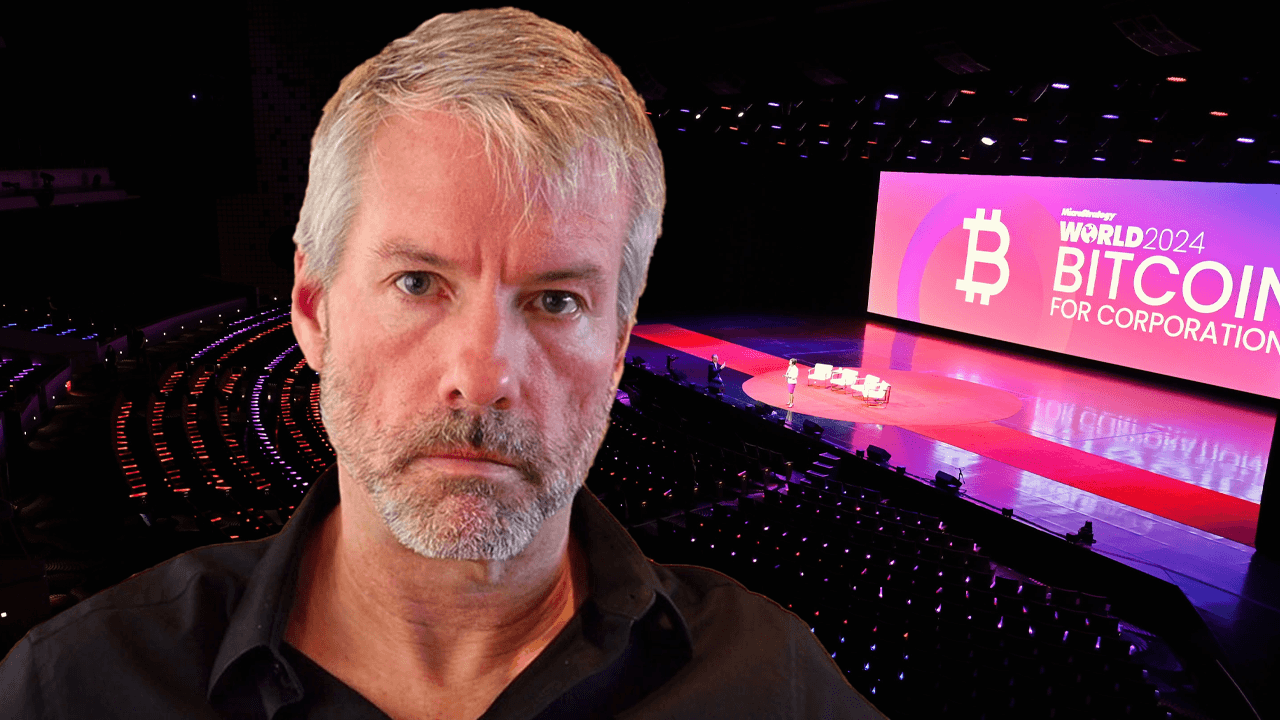

MicroStrategy, led by Michael Saylor, is making waves in the financial world with its audacious Bitcoin strategy. The company is set to seek shareholder approval to increase its authorized Class A common shares from 330 million to an unprecedented 10.3 billion. If this proposal passes on January 21, MicroStrategy could rival market giants like Amazon and Alphabet in the number of available shares. This move underscores its commitment to Bitcoin, which has become central to its business strategy.

Since pivoting to Bitcoin in 2020, MicroStrategy has seen its stock surge over 2,500%, outpacing Bitcoin’s own remarkable 800% growth during the same period. This strategic shift has earned the company a unique position in the market as a leveraged Bitcoin proxy. Through equity and debt sales, MicroStrategy has already amassed over $44 billion in Bitcoin holdings, with plans to expand further.

Also Read:- Bills Triumph Over Ravens to Secure Spot in AFC Championship

- Thrilling Start to Women’s Ashes 2025: Australia vs England T20 Clash

The proposed share increase is a double-edged sword. On the one hand, it enables MicroStrategy to continue raising capital for its Bitcoin acquisition strategy. On the other hand, it raises concerns about dilution of shareholder value, a typical investor apprehension. However, MicroStrategy’s shareholders appear less perturbed, possibly due to the exceptional returns they've enjoyed thus far.

Saylor’s strategy goes beyond Bitcoin acquisition. He envisions Bitcoin as the foundation of a future financial system where tokenized assets dominate, potentially pushing Bitcoin’s value to astronomical heights. While skeptics doubt the feasibility of such a shift, Saylor remains undeterred, advocating for a decentralized, Bitcoin-backed economy.

The market will closely watch the outcome of MicroStrategy's shareholder meeting. A successful vote would not only cement the company’s commitment to Bitcoin but could also set a precedent for other firms exploring similar strategies. As Bitcoin’s journey unfolds, MicroStrategy’s role in shaping its future is undeniable. For investors, this bold move is both an opportunity and a calculated risk in the ever-evolving crypto landscape.

Read More:

0 Comments