Asian Markets Rattled as Global Sell-Off Deepens Amid Tariff Turmoil

Well, it’s safe to say Monday didn’t exactly start on a high note for the markets. After a brutal end to last week on Wall Street—with stocks plunging nearly 6% across the board—Asia stepped into the new trading week only to inherit the bloodbath. The core driver? Escalating tariff tensions between the US and China, effectively crumbling the long-standing Chimerica economic dynamic. Throw in a bit of stronger-than-expected US jobs data that no one really cared about, and we’ve got the perfect storm.

Despite a brief rally in the US dollar following the jobs report, the Australian dollar took the worst of it—nosediving toward the 60-cent level. That’s a level we haven’t seen since COVID times, and it’s not just a currency story here; it’s tied deeply to China’s retaliatory tariffs and commodity fears. Meanwhile, the euro attempted a mini-surge but fizzled out around the 1.09 level after the initial NFP hype wore off.

Looking at bonds, US 10-year Treasury yields briefly dipped below 4%, giving a faint signal of recession panic, before rebounding slightly. The yield curve? Still screaming slowdown. And as for oil—well, that rally’s dead. Brent crude’s been slammed back to around $65 a barrel after OPEC+ announced new production quotas. Just like that, all of last week’s gains evaporated.

Also Read:- "A Minecraft Movie" Builds a Box Office Empire With $157M Debut

- Canadiens Aim for Fifth Straight Win as They Tame the Predators in Nashville

Asian equities didn’t stand a chance. Chinese markets were closed for a holiday, maybe thankfully so, considering the carnage. The Hang Seng’s recent gains are now looking shaky, slipping toward the 20,000 point level again. Japanese markets were hammered too, with the Nikkei closing nearly 3% lower and volatility in the Yen just adding to the chaos.

Back home, the ASX200 dropped 2.5% on Friday, but futures are already pointing to a 4.5% slump on Monday’s open. It’s the ripple effect from Wall Street and the knock-on impact of Chinese counter-tariffs. There might be a relief bounce soon, but right now, it’s looking like more pain ahead.

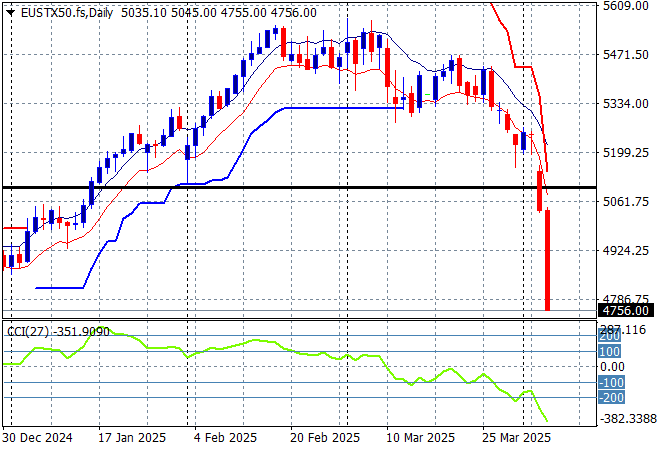

Europe didn’t escape either. The Eurostoxx 50 was dragged down 4.6%, with support levels collapsing and momentum heading straight into oversold territory. US markets continued their collapse too—NASDAQ and S&P500 both registering their worst single-day losses in over five years. The so-called Trump-era “pump and dump” is living up to its name—now firmly in the dump phase.

Currencies saw a quick bounce against the USD following Trump’s new tariff rhetoric, but that reversed just as quickly. Euro couldn’t hold 1.10, the Pound retreated, and commodity currencies like AUD got clobbered. The USDJPY pair swung wildly, with Yen strength dragging it down toward the 145 mark before a small recovery. But the fear is real—especially for Japan’s export sector.

And then there’s gold. It had been the calm in the storm, but even that cracked—falling back below $3050 and settling closer to $3020. It might stabilize from here, but clearly, not even gold is immune when markets are in full risk-off mode.

So yeah, it's a mess out there. Tariffs are flying, currencies are tumbling, and stock markets are desperately searching for a floor. Strap in—it looks like this storm isn’t passing anytime soon.

Read More:

0 Comments