TSX Composite Surges Ahead of Trump's Tariff Announcement

Hey everyone, let’s talk about what’s been happening with the stock market today. If you’ve been watching the TSX Composite, you probably noticed it closed higher, making some gains ahead of a major announcement from former U.S. President Donald Trump regarding tariffs. Now, this is a big deal because every time tariffs come into play, markets tend to react—sometimes sharply.

So, here’s the breakdown. The S&P/TSX Composite Index ended the day in positive territory, defying some of the initial uncertainty that was floating around earlier. This is interesting because U.S. markets also managed to close higher despite looming concerns over Trump's expected tariff policies. Investors were definitely keeping an eye on the news, and it seems like there was enough confidence in the market to push stocks higher before any official details were released.

Now, why does this matter? Well, tariffs have a direct impact on trade, and trade is a massive driver of economic activity. If Trump’s new policies introduce heavier tariffs, we could see supply chains shift, production costs rise, and ultimately, volatility in the markets. Some analysts believe this could even lead to higher inflation and slower global economic growth. However, the Canadian market seems to have shrugged off those worries for now, showing resilience ahead of the big reveal.

Also Read:- Buckman Bridge Reopens After Police Activity Causes Temporary Shutdown

- The Grand National 2025: Who Will Conquer Aintree?

Across the border, U.S. markets also ended in the green, with the Dow Jones, S&P 500, and Nasdaq all gaining ground despite the uncertainty. That’s a pretty strong sign that investors might not be as fearful as expected—or maybe they’re just positioning themselves carefully ahead of any fallout.

Another key element in today's financial scene was the movement in commodities. Oil prices dipped slightly as concerns grew over how tariffs might influence global demand. At the same time, gold prices inched up, signaling that some investors were looking for a safety net in case things got rocky.

Now, let’s talk about the Canadian dollar. It saw some movement against the U.S. dollar but remained within a relatively stable range. Given the potential economic shifts that could come from Trump's announcement, currency markets are likely to be an area of focus in the coming days.

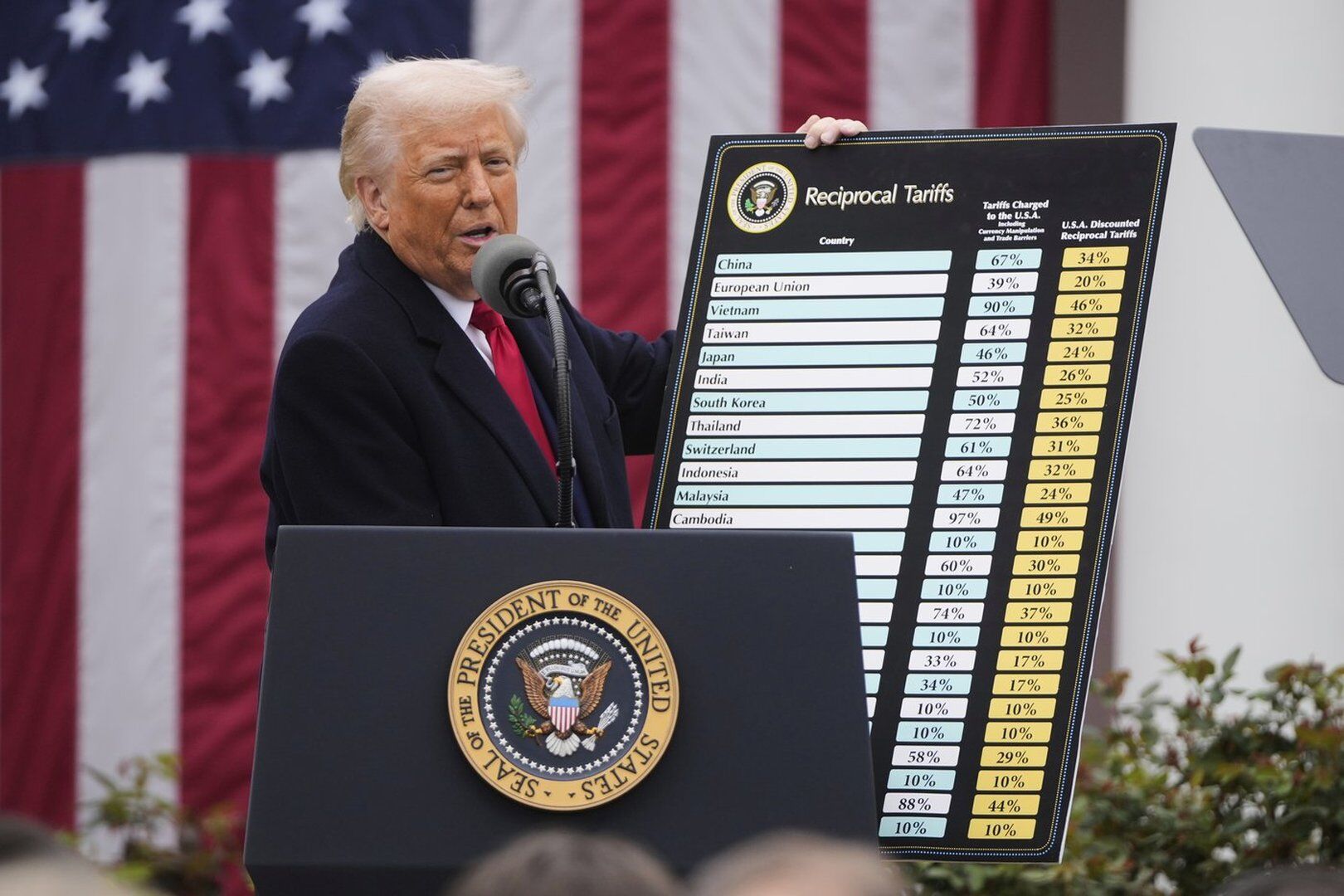

So, what should we expect next? Well, all eyes will be on Trump’s official statement and the details surrounding these new tariffs. Will they be broad? Will they target specific industries? And most importantly, how will other countries, including Canada, respond? If history has taught us anything, it’s that tariff announcements can have ripple effects, and we might see some adjustments in the markets once more information comes out.

For now, though, it looks like the TSX is holding strong. But as always, when major political and economic decisions are at play, it’s a good idea to stay informed and keep an eye on market movements. Stay tuned, and we’ll see how this all plays out in the days ahead!

Read More:

0 Comments