The Reserve Bank's decisions on interest rates have been a topic of widespread speculation and discussion. In this article, we will delve into recent insights from various sources to understand why the Reserve Bank might delay interest rate cuts until 2025.

The Reserve Bank's Dilemma:The Reserve Bank's approach to interest rates is a critical factor influencing economic conditions. Recent reports from oneroof.co.nz suggest that there might be hesitancy in cutting interest rates until 2025. This decision could have significant implications for various sectors, including mortgage holders and the broader economy.

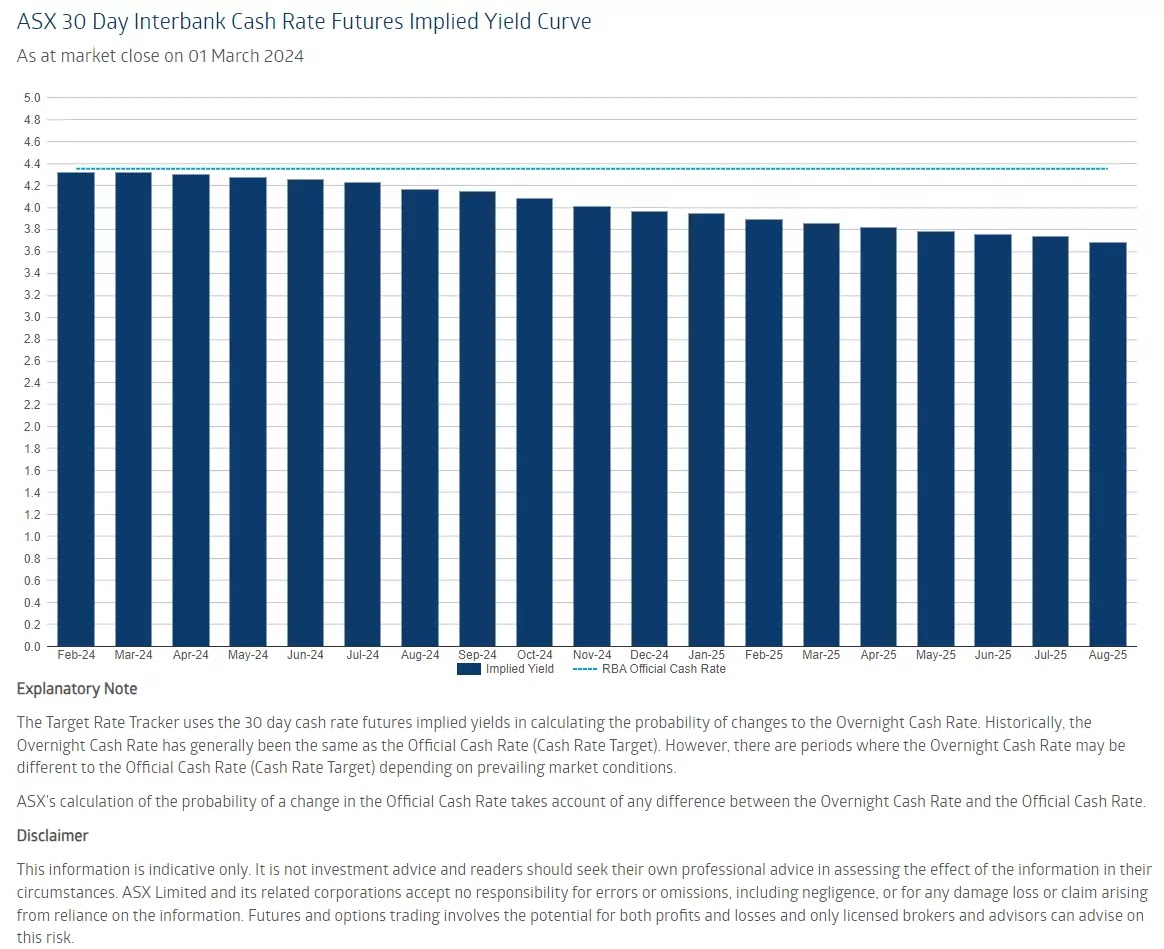

Factors Influencing the Reserve Bank's Decision:The macrobusiness.com.au report highlights that futures traders are now anticipating rate cuts. However, the timing and extent of these cuts remain uncertain. Examining the factors influencing the Reserve Bank's decision-making process is crucial to understanding the potential delay in rate cuts.

Also Read:- Alexander Nylander's Stellar Performance Secures First Career Hat Trick

- Martin Odegaard's Impact on Arsenal: A Closer Look

Global Economic Landscape:The global economic landscape plays a vital role in shaping the Reserve Bank's decisions. Reports from news.com.au emphasize the challenges and uncertainties in the current economic environment. Factors such as inflation rates, global economic recovery, and geopolitical events all contribute to the complexities faced by central banks in determining interest rate adjustments.

Impact on Mortgage Holders:Mortgage holders are particularly sensitive to changes in interest rates. The dailymail.co.uk article discusses the potential consequences of interest rate drops, presenting both positive and negative aspects. Understanding how these changes might affect millions of Aussies with mortgages is crucial for anticipating economic shifts.

The Road Ahead:As we navigate through these uncertainties, it becomes clear that the Reserve Bank faces a delicate balancing act. The decision to cut interest rates involves weighing economic indicators, global trends, and domestic considerations. Investors, businesses, and individuals alike are closely monitoring developments, awaiting clarity on the future trajectory of interest rates.

So, the Reserve Bank's decision on interest rates remains uncertain, with potential implications for various sectors. This article has provided an overview of recent insights, emphasizing the complexities involved in predicting and understanding these economic shifts. As we move forward, staying informed and monitoring key indicators will be essential for making informed decisions in the face of economic uncertainties.

Keywords: Reserve Bank, interest rates, economic landscape, mortgage holders, global trends, uncertainty, economic conditions, rate cuts.

Read More:- The Durham Byelection: A Closer Look at the Political Dynamics

- Russell Westbrook's Injury Woes: Clippers' Star Guard Faces Uncertain Timetable

Thanks for Visiting Us – FixyaNet.com

0 Comments