XDUOutpaces SCHD as the Top Dividend ETF for 2024

In 2024, the iShares Core MSCI US Quality Dividend Index ETF (XDU

) is turning heads by outperforming the widely popular Schwab U.S. Dividend Equity ETF (SCHD). SCHD has long been a favorite for dividend investors due to its strong historical performance and yield balance. However, with shifting market conditions and sector performance trends, XDU

has emerged as a serious contender, offering superior risk-adjusted returns and more stability in a challenging economic environment.

SCHD's appeal has traditionally been rooted in its ability to balance growth with dividends. It's packed with U.S. companies known for stable dividends, and its expense ratio and yield have made it a go-to choice for income-focused investors. But since 2020, SCHD's performance has lagged behind the tech-heavy S&P 500 and has struggled to adapt to some of the market's evolving demands, particularly in the face of rising inflation and fluctuating energy prices. This is where XDU

shines.

Also Read:

- Exploring the Mellow Romance of "Lonely Planet" on Netflix

- Trevor Sorbie Shares Heartbreaking Terminal Cancer Diagnosis on This Morning

XDU

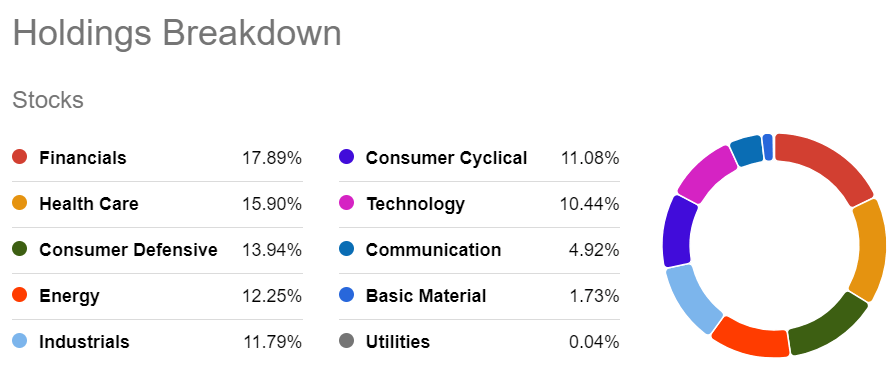

focuses on defensive sectors, such as consumer staples, healthcare, and utilities, which tend to perform well during periods of economic uncertainty. Its lower volatility, combined with a strategic focus on dividend-paying companies, has made it an attractive option in 2024. Investors looking for a more conservative approach have turned to XDU

, especially given its exposure to sectors that can weather market turbulence better than tech-heavy or cyclical sectors.

Additionally, XDU

’s screening process for financial strength allows it to build a more resilient portfolio. By concentrating on quality dividend-paying companies, XDU

offers a portfolio that can perform well even during lower inflationary or deflationary periods. Investors seeking stability, particularly those nearing retirement, have been drawn to XDU

’s strategy.

In short, while SCHD remains a solid choice for dividend investors, 2024 has seen a shift in momentum towards XDU

. Its superior sector allocation, defensive strategy, and potential for better risk-adjusted returns make it a top contender for those looking for quality and reliability in a turbulent market.

Read More:

0 Comments