Nvidia’s Price Crash Sends Shockwaves Through Aussie Super Funds

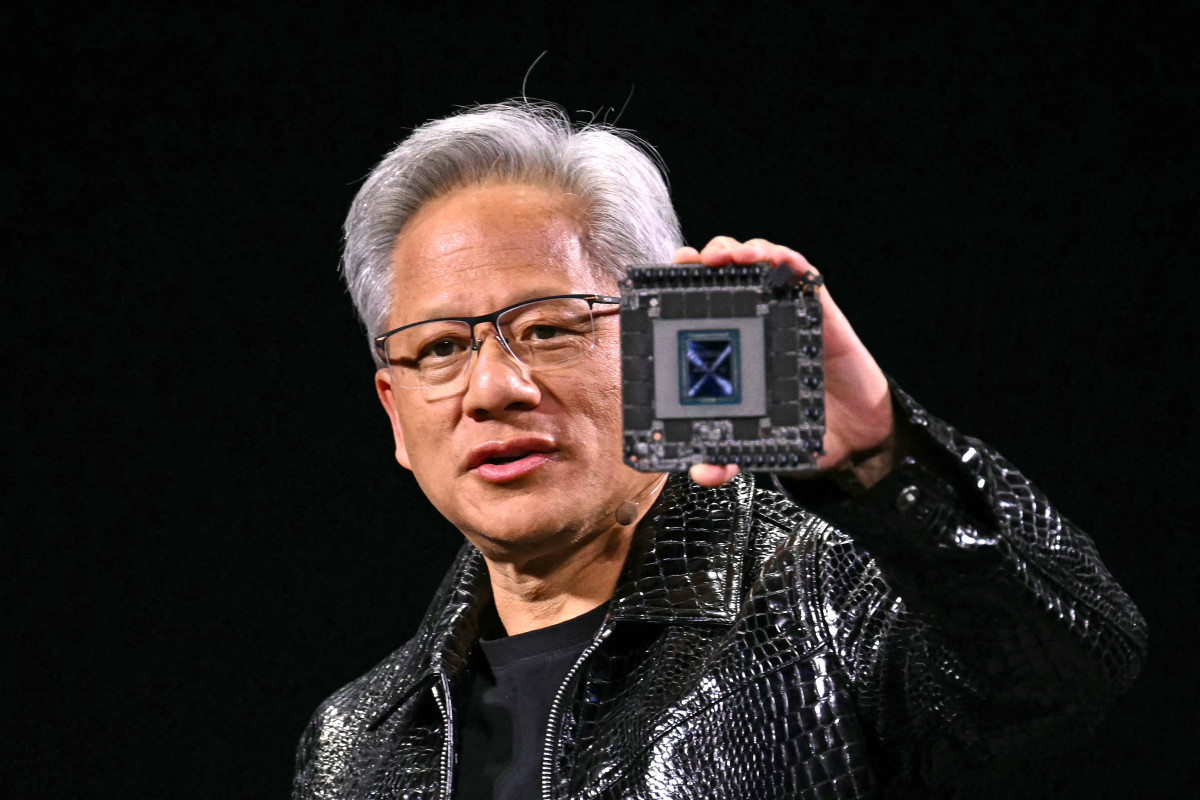

Let’s talk about something that’s really hit Aussie investors hard — and no, it’s not beef tariffs or political posturing. It’s Nvidia. Yes, the AI darling that soared to dizzying heights last year has suddenly come crashing back down, and the fallout is being felt all the way across the Pacific.

In just a few short months, Nvidia has lost around 27% of its value — dropping from about $US140 a share in January to around $US102 now. That sharp decline translated to an eye-watering $8 billion in losses for Australian institutional investors. It’s not just a financial headline; it’s a real blow to our superannuation funds, retirement savings, and the broader sense of confidence in US tech stocks.

Here’s where it gets serious: as of earlier this year, Aussie super funds and fund managers had about $28 billion tied up in Nvidia. That’s a significant chunk of change — and it’s taken a major hit. VanEck’s executive Jamie Hannah shared that local institutional investors still held around $20 billion worth of Nvidia shares as of last night. So, we're talking billions lost in just a few months.

Even big-name investors like James Packer aren’t immune. Through one of his private investment arms, he owns over a million Nvidia shares. That’s more than $US50 million wiped from his portfolio since January. Though it doesn’t necessarily mean he’s lost money overall — he might’ve gotten in early — it highlights just how deep the exposure goes.

AusSuper, our largest super fund, reportedly holds as many as 7.8 million Nvidia shares. That alone adds up to losses exceeding $US370 million. And that’s just one fund. Multiply that kind of exposure across the $4.1 trillion superannuation system, and you start to understand the scale. We’re not just bystanders watching Wall Street crash — we’re passengers on the same train.

And what’s causing this tech wreck? The ripple effects of US President Trump’s latest tariff regime. These new tariffs, part of what he’s branded “Liberation Day,” are causing massive uncertainty in global markets. Chief economists are warning that if these tariffs stick around for more than a few months, a recession might be unavoidable.

The drop in Nvidia is just one piece of a much bigger story. The Magnificent Seven tech stocks — think Apple, Microsoft, Google, and the like — lost nearly $US1 trillion in value in a single night. Apple actually fell even harder than Nvidia, sliding over 9%.

Also Read:- April 30 Victory – A Defining Moment in Vietnam’s History

- 44 Hours Stranded: Virgin Atlantic Passengers Stuck in Turkey Finally Headed to Mumbai

But amid the chaos, some analysts are seeing opportunities. VanEck’s Arian Neiron pointed out that this environment might be ripe for diversification, especially into sectors and regions that have been under-loved. One silver lining? Gold. With all this economic uncertainty, gold is hitting record highs, and Australian producers could benefit from currency shifts brought on by these global trade tensions.

So while it’s a painful moment for Aussie investors — especially those with heavy exposure to US tech — it’s also a wake-up call. We’ve leaned heavily into American markets, and when they shake, we feel the tremors here at home.

Nvidia’s Market Tumble Hits Aussie Investors Where It Hurts

So here’s the deal — while everyone's been focused on beef tariffs and political noise, the real gut-punch to Australian investors has come from the collapse in Nvidia’s share price. We're talking billions wiped out from local portfolios — and fast. Forget the supermarket shelves or export headlines — this is where the real financial pain is being felt.

Since the beginning of the year, Nvidia shares have nosedived from about $US140 to $US102, which might not sound catastrophic until you zoom out and realise how much Aussie money is tied up in it. According to VanEck, institutional investors here held around $28 billion worth of Nvidia stock in January. Now? That’s shrunk to about $20 billion. That’s an $8 billion hit in just a few months — and it’s not just big funds feeling the sting.

Even high-profile investors like James Packer have taken a huge blow. One of his private investment arms, Consolidated Press International Holdings, holds over a million Nvidia shares. That means he's likely down more than $US50 million since the start of the year — though to be fair, that doesn’t necessarily mean he’s lost money overall on the investment. Still, it’s a serious haircut.

Then there’s AusSuper — Australia’s largest super fund — which reportedly holds up to 7.8 million Nvidia shares. With the recent share price drop, their loss alone is estimated at over $US370 million. Multiply that across the entire $4.1 trillion superannuation system, with so much of it riding on the US market, and you're looking at widespread impact.

Why does this matter? Because this isn't just about tech stocks having a bad day. This ties directly to the broader chaos hitting Wall Street, driven in large part by US President Donald Trump's aggressive new tariffs. These moves are shaking investor confidence globally, with economists warning of a potential US recession if the tariffs stick around. And when the US market catches a cold, Australia sneezes hard — especially with so much of our retirement savings linked to American equities.

It gets worse — last night alone, the so-called "Magnificent Seven" tech stocks lost nearly $US1 trillion in market value. Apple actually took a bigger percentage hit than Nvidia, dropping more than 9%, but Nvidia’s popularity with Aussie investors makes its tumble hit a lot closer to home.

But it's not all doom and gloom. There’s growing talk among experts about pivoting towards under-owned markets and assets, with gold shining bright as a potential hedge. With record prices and a weaker currency environment thanks to global trade tensions, Aussie gold producers could become an unexpected safe haven.

At the end of the day, the Nvidia wipeout is a wake-up call for Australian investors. Our love affair with US tech stocks has delivered big gains, but it's also left us dangerously exposed. And right now, that exposure is costing us — big time.

Read More:

0 Comments