TSX Today: What Every Canadian Investor Needs to Know

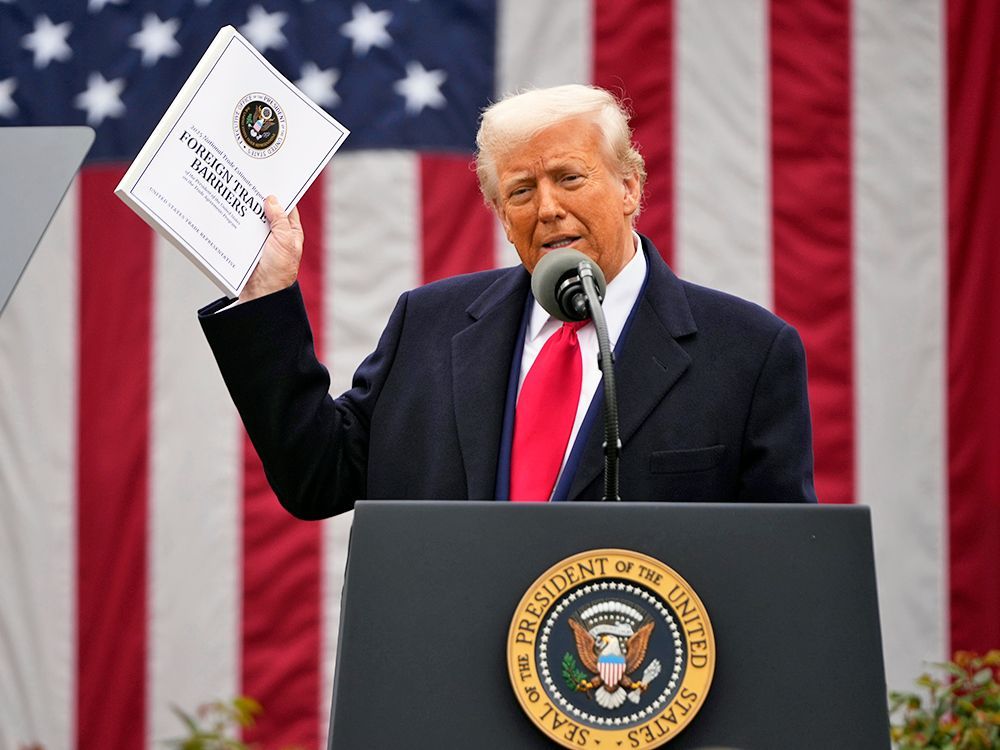

Hey everyone, let's talk about what’s happening in the markets today because it’s a big one. Global stocks are taking a serious hit after China retaliated with new tariffs—34% on all U.S. goods—following President Trump’s latest trade moves. This escalation in the ongoing trade war is shaking investor confidence worldwide.

In the U.S., markets opened deep in the red. The Nasdaq Composite is officially in bear market territory, with the Dow Jones Industrial Average falling by 2.45% to 39,551.47, the S&P 500 losing 2.48% to 5,262.47, and the Nasdaq plunging 2.86% to 16,077.44. Here in Canada, the TSX Composite Index opened 2% lower at 23,850.06, led by energy and mining losses.

Market analysts are now questioning whether Trump might seek a way out of these aggressive trade policies if they continue to wreak havoc. David Bahnsen, CIO at The Bahnsen Group, even warned that if these tariffs hold, we could see a recession by Q2 or Q3 and an extended bear market.

Over in Europe, the losses are just as severe. The STOXX 600 is down 4.08%, the FTSE 100 dropped 3.12%, Germany’s DAX fell 4.02%, and France’s CAC 40 declined 3.68%. Meanwhile, in Asia, Japan’s Nikkei closed 2.75% lower, and the Hang Seng in Hong Kong dropped 1.52%.

Also Read:- Dow Jones Plummets as China Fires Back in Escalating Trade War

- Mumbai Indians Opt to Bowl First Against Lucknow Super Giants in IPL 2025

Commodities are also feeling the pressure. Oil prices plunged nearly 8%, reaching lows we haven’t seen since the COVID-19 crisis in 2021. Brent crude fell to $64.84 per barrel, and WTI crude dropped to $61.42. Analysts fear this trade war could significantly hurt global economic growth, further reducing demand for oil and other key commodities.

Gold, however, is holding steady as a safe haven. Spot gold climbed 0.5% to $3,128.76 per ounce, while U.S. gold futures rose 0.9% to $3,151.20.

On the currency side, the Canadian dollar weakened against the U.S. dollar, trading between 70.38 and 71.16 U.S. cents in early trading. Despite today’s drop, the loonie is still up about 1.38% against the greenback over the past month. Meanwhile, the U.S. dollar index rebounded slightly, rising 0.21% to 102.28 after experiencing its biggest single-day drop since November 2022.

Looking at bonds, the yield on the U.S. 10-year Treasury note edged down to 3.946%.

Finally, on the economic front, Canada’s employment numbers for March are in, and the results aren’t great. We saw a net loss of 32,600 jobs—the first decline in over two years—despite expectations of a 15,600 job increase. Meanwhile, the U.S. labor market remains resilient, with nonfarm payrolls increasing by 228,000 jobs, far surpassing the 135,000-job estimate. However, with global trade tensions rising, even a strong job market may face challenges ahead.

So, what does this all mean for investors? Right now, market volatility is high, and uncertainty around trade policies is driving sharp declines. If you’re investing, stay informed, manage risk carefully, and consider safe-haven assets like gold or defensive stocks.

That’s the latest update on TSX and global markets. Stay tuned for more developments as this trade war unfolds.

Thanks for watching, and don’t forget to keep an eye on the markets!

Read More:

0 Comments