Intuitive Machines Stock Holds Strong Buy Rating with Promising $11 Price Target

Today, we're diving into some exciting news surrounding Intuitive Machines (NASDAQ: LUNR), a company making significant strides in the space exploration sector. Recently, Canaccord Genuity reaffirmed its "Buy" rating on Intuitive Machines' stock, maintaining a price target of $11. This decision highlights the firm's confidence in Intuitive Machines' potential for growth, particularly as the company continues to expand its foothold in the cislunar and lunar surface economy.

Intuitive Machines has been actively diversifying its portfolio, securing high-profile contracts such as the NASA Simplified Lunar Payload Services (NSPS) and Lunar Terrain Vehicle (LTV) programs. These contracts are pivotal as they aim to establish a dominant presence in the emerging space economy. The company's success in previous space missions has not only bolstered its reputation but also increased demand from commercial payload customers, who are now looking to access space through Intuitive Machines' innovative solutions.

Also Read:- Heartfelt Tributes Pour in for Six-Year-Old Joseph Hegarty Following Tragic Quad Bike Accident

- Disney Reverses Stance, Allows Wrongful Death Lawsuit to Proceed in Court

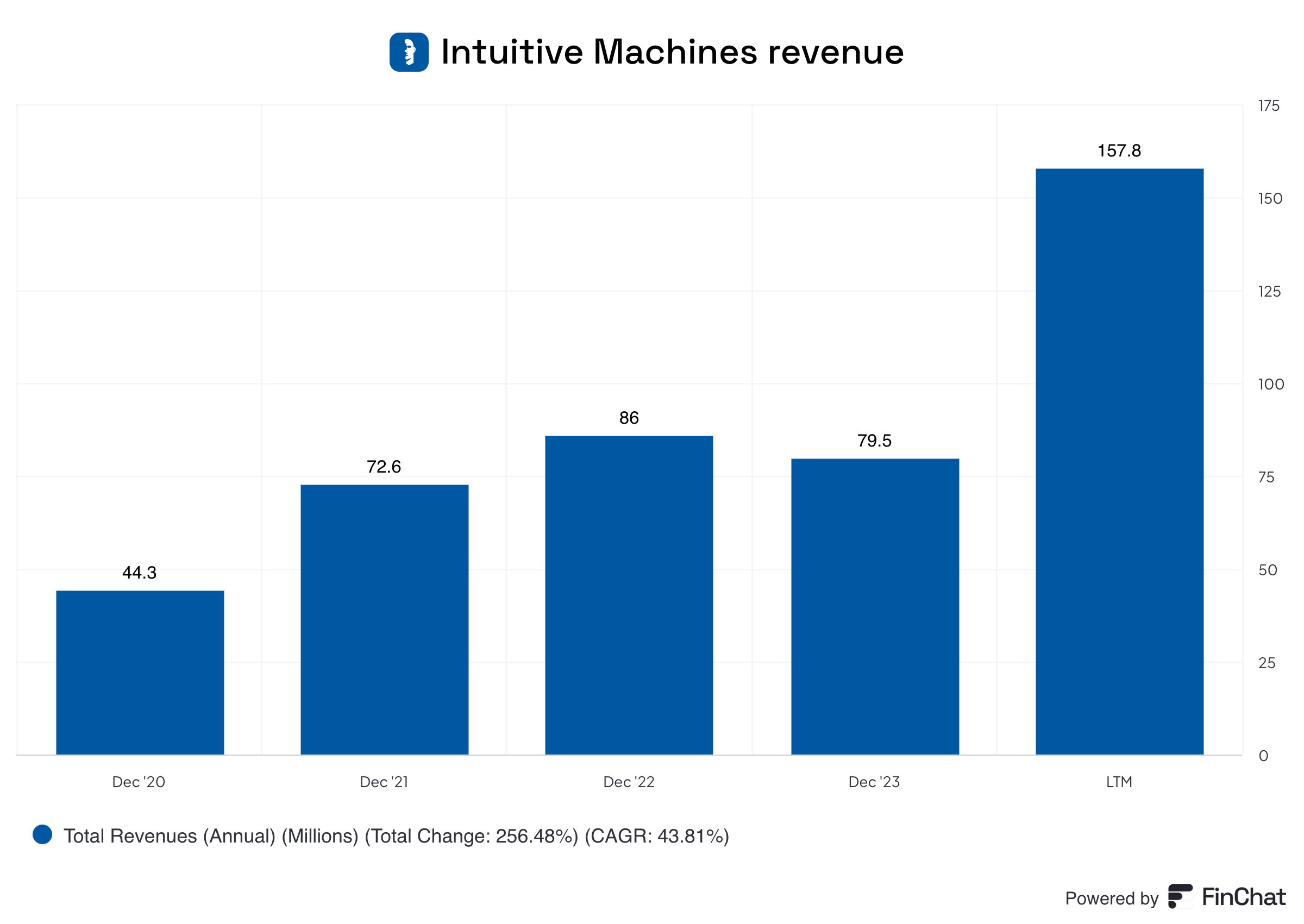

The financial outlook for Intuitive Machines is equally impressive. The company reported a remarkable Q2 2024 revenue of $41.4 million, more than doubling its revenue from the same quarter in 2023. This surge has driven the company's revenue for the first half of the year to $114.5 million, surpassing its entire revenue for 2023. Consequently, Intuitive Machines has revised its full-year revenue forecast upwards, now projecting a range of $210 million to $240 million.

Adding to the company's robust financial performance, Intuitive Machines has secured nearly $70 million in new contracts, bringing its total contracted backlog to $213 million. This backlog is expected to grow further throughout the year, as the company anticipates securing additional key program awards.

However, it's important to note that while the company's revenue growth is impressive, there are some financial challenges. Despite the strong top-line growth, Intuitive Machines is currently operating with negative profit margins. The company's gross profit margin stands at -9.58%, and its operating income margin is at -34.77%. Additionally, the company is not yet profitable and is rapidly burning through cash, a factor that potential investors should consider.

So, while there are challenges ahead, Intuitive Machines' strong performance and strategic positioning in the space economy make it a stock to watch. Canaccord Genuity's "Buy" rating and $11 price target reflect a positive outlook for the company, as it continues to capitalize on the growing opportunities in space exploration. For investors, Intuitive Machines represents both a high-risk and potentially high-reward opportunity in the rapidly evolving space industry.

Read More:

0 Comments