AST SpaceMobile’s Expanding Satellite Network Positions It as a Strong Buy Opportunity

AST SpaceMobile, Inc. (NASDAQ: ASTS) has been gaining remarkable attention in the investment world, particularly due to its innovative approach to satellite-based mobile connectivity. Recently, the company has seen a surge in stock value, largely driven by partnerships with major telecom players like Verizon and AT&T. These alliances are significant, as they enable AST SpaceMobile to expand coverage across the continental United States, with the potential to extend connectivity to more underserved and remote regions. The strength of AST’s technology is becoming increasingly evident, and these partnerships serve as a validation of its mission and capabilities in a rapidly evolving market.

An upcoming milestone for AST SpaceMobile is the scheduled launch of 17 Block 2 satellites in the first quarter of 2025. This fleet will mark a significant leap in service capability, promising a 10x improvement in bandwidth, a critical factor for meeting growing connectivity demands. While AST SpaceMobile faces substantial capital expenditures and operational costs, its vertically integrated production model offers tight control over satellite manufacturing, helping it ramp up production capacity to six satellites per month. This in-house production strategy could prove advantageous as AST scales its operations, potentially reducing costs and accelerating deployment timelines.

Also Read:- Toadie Rebecchi’s Return toNeighboursSparks Major Drama on Ramsay Street

- Australia Proposes "World-Leading" Social Media Ban for Under-16s

Despite some operational challenges and a high valuation, AST SpaceMobile’s ambitious strategy and growing network of partners have kept investor sentiment strong. Although there have been concerns over shareholder dilution and financial sustainability due to high cash burn, the company’s potential to reshape global connectivity makes it an attractive, albeit risky, opportunity. Its efforts to achieve near-global coverage could fulfill a unique need in the market—bringing mobile connectivity to areas previously beyond reach.

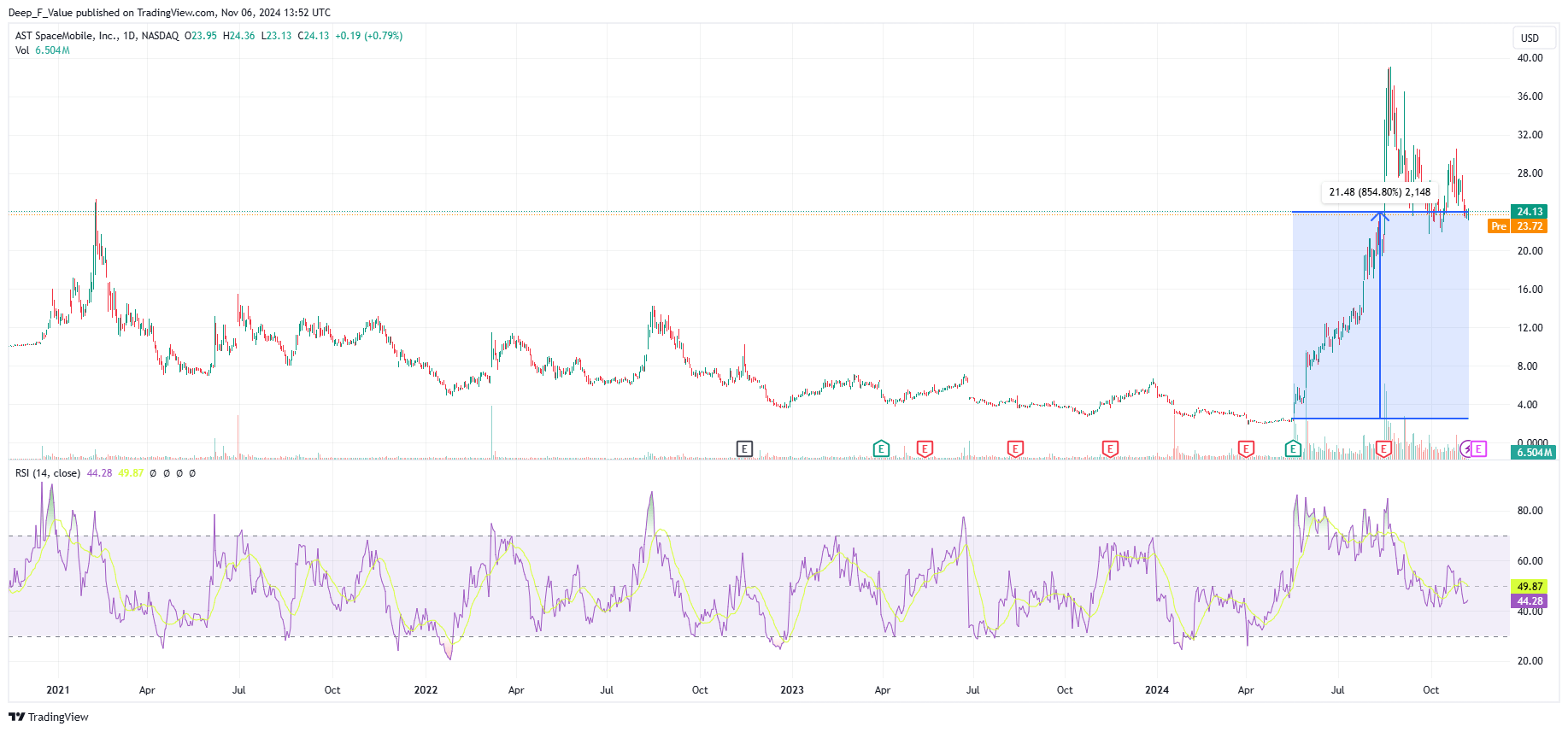

In addition, AST SpaceMobile’s impressive stock performance, with an 850% increase in value since May 2024, reflects strong investor confidence. This surge indicates growing interest not only from retail investors but also from institutional stakeholders who see the long-term potential of AST’s satellite technology. Looking ahead, AST SpaceMobile is positioned to become a major player in the telecom industry, particularly as demand for mobile and satellite-based connectivity solutions expands worldwide.

As AST SpaceMobile progresses, the success of its planned satellite launches and its ability to manage capital expenditures will be crucial in achieving its ambitious coverage goals.

Read More:

0 Comments