Stock Market Gains on Positive Apple Earnings and Economic Data

In today’s stock market update, we saw a positive trend across major indices, with the Nasdaq, S&P 500, and Dow Jones all making gains. The rally was sparked by strong earnings from Apple and a crucial economic data report that kept inflation in check. This boost in stock performance signals that investors are cautiously optimistic about the future despite some ongoing economic concerns.

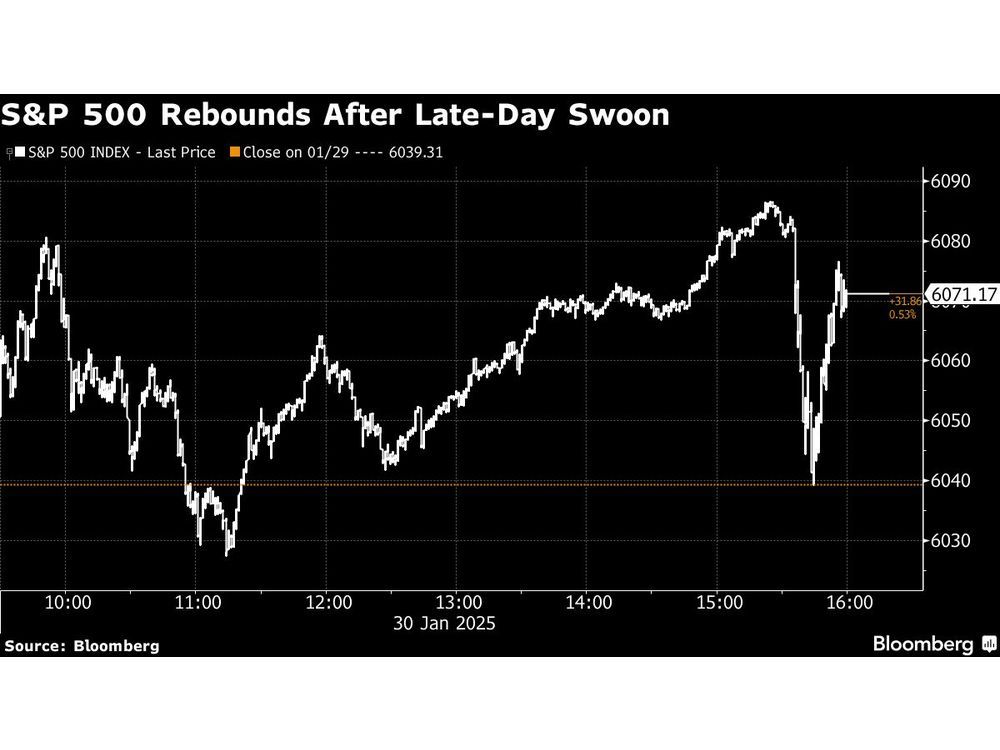

The tech-heavy Nasdaq Composite surged by 0.9%, benefiting from solid earnings in the technology sector, particularly from Apple. Meanwhile, the S&P 500 climbed around 0.5%, and the Dow Jones Industrial Average added a modest 0.3%. Apple’s strong quarterly results played a central role in these gains, especially after the company reported a first-quarter profit that exceeded expectations. Despite a slight dip in iPhone and China sales, investors remain upbeat about Apple's revenue growth, which they view as a potential sign of recovery in the coming months.

Also Read:- Remembering Kenneth (Ken) Beck: A Life Filled with Love, Laughter, and Music

- A Look Ahead at the 2025 Hilton Grand Vacations Tournament of Champions

On a broader economic scale, investors are also keeping a close eye on the Federal Reserve’s inflation gauge, the Personal Consumption Expenditures (PCE) index. The core PCE, which excludes volatile food and energy prices, rose by 2.8% year-over-year in December, in line with analysts' expectations. This is significant because it means inflation is still above the Fed’s 2% target, but not growing at an alarming pace, which may give the central bank some room to maneuver with its monetary policy.

However, the mood on Wall Street isn’t entirely risk-free. A looming tariff deadline, which President Trump recently highlighted, has raised concerns. The U.S. is set to impose a 25% tariff on imports from Canada and Mexico by February 1st. This potential tariff could add economic pressure, especially considering these countries are major trading partners. Additionally, Trump warned that BRICS countries would face substantial tariffs if they move away from using the U.S. dollar in favor of their own currency. This uncertainty continues to fuel market volatility, as the economic impact of these decisions remains unclear.

Despite these challenges, the stock market is generally holding strong. For the Dow, January’s gains are noteworthy, with the index poised to finish the month with a robust 5% increase. The broader market is also seeing strength, with several companies, including Apple, driving the tech sector higher. Investors are cautiously optimistic, though the potential for rising tariffs and other geopolitical uncertainties could keep the market on edge in the weeks ahead.

As we head into February, the balance between strong earnings reports and geopolitical risks will continue to shape market sentiment. With more earnings expected and potential rate cuts from the Federal Reserve in the coming months, the stock market remains a space where investors will need to stay vigilant but remain hopeful for a continued recovery.

ChatGPT can think longer before responding, for better answers to your biggest questions.

Read More:

0 Comments